how are rsus taxed in california

Moves to California 100 shares vest this month. Has anyone here with an RSU grant left California and become a resident of a state with no income tax and your company had an office in that state.

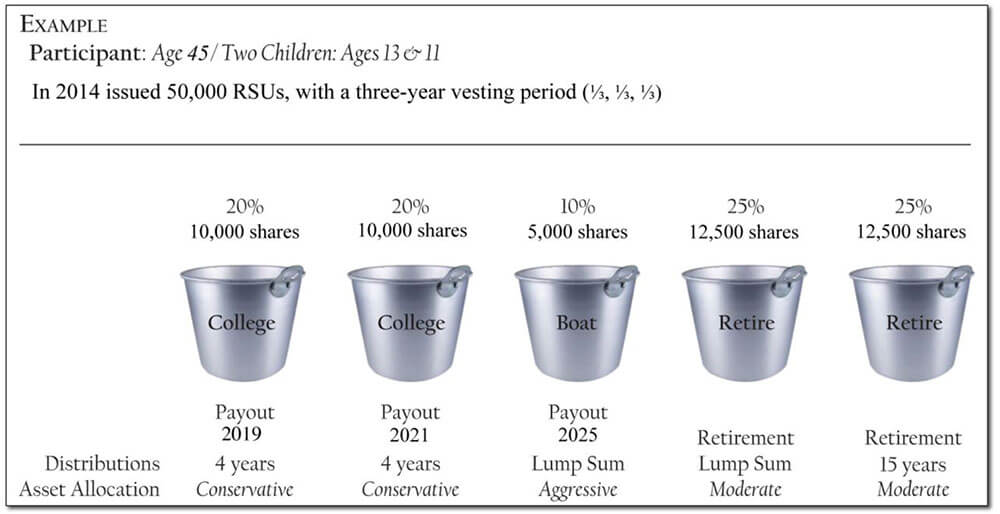

Restricted Stock Units Jane Financial

RSUs can trigger capital gains tax but only if the stock holder chooses to not sell the stock and it increases in value before the stock holder sells it in the future.

. Answer 1 of 4. You lived in California through June 30th and moved to Washington on July 1st. Not a resident of California granted equity of 6000 shares vesting monthly over 5 years ie 100 share per month for 5 years - January 2020.

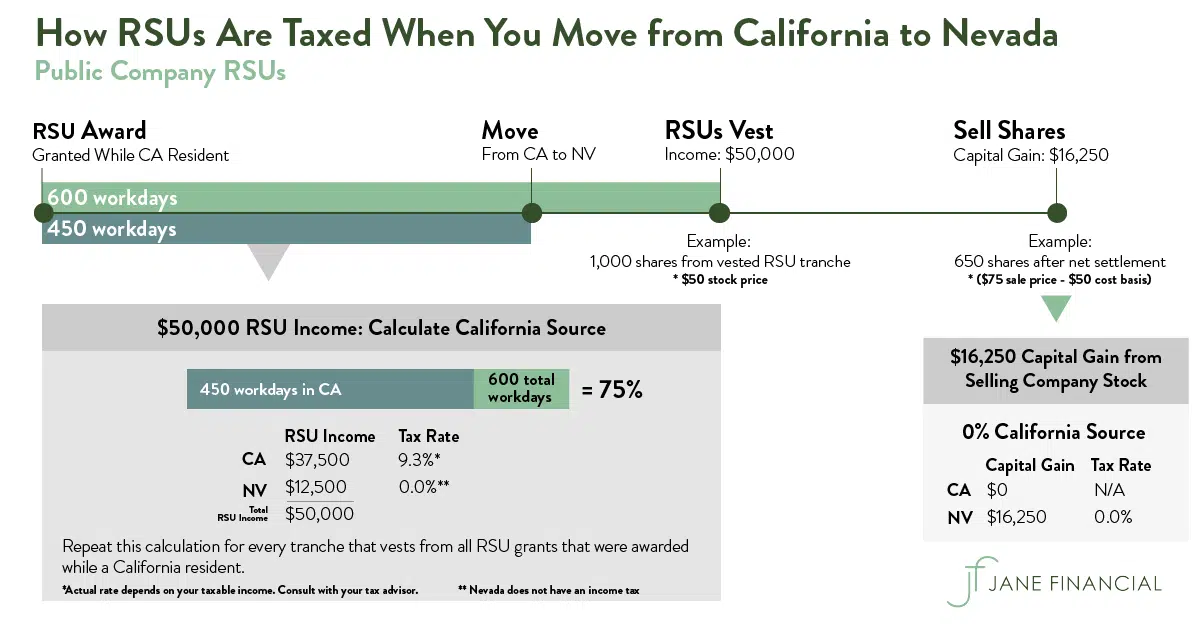

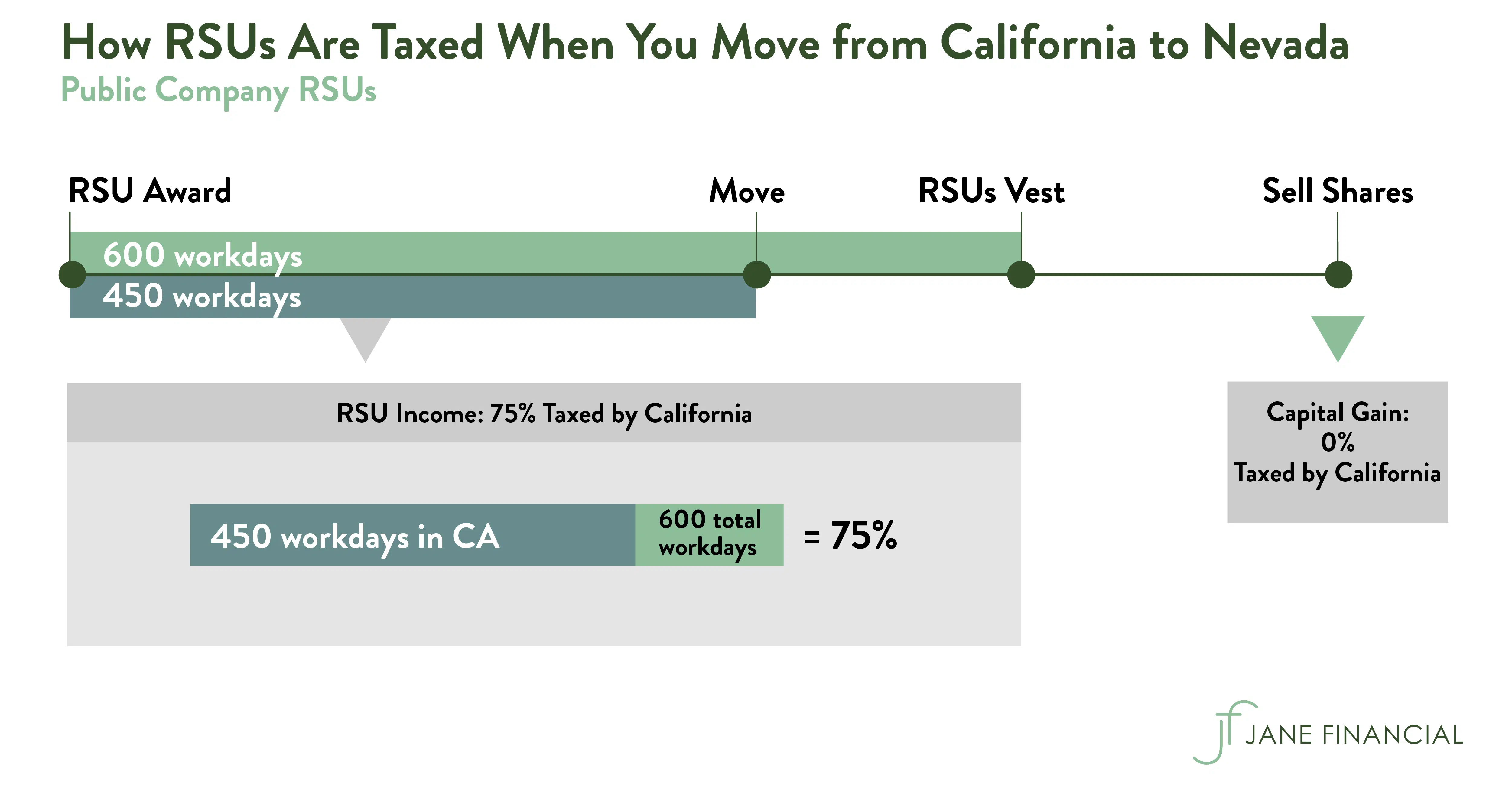

At vesting date California taxes the portion of the income from RSUs that corresponds to the amount. Taxes at RSU Vesting When You Take Ownership of Stock Grants. Sell to cover is the default arrangement and the best.

With rsus youre subject to california income tax when the shares are delivered to you. If so has the California FTB come after you. Nov 18 2020 17 Comments.

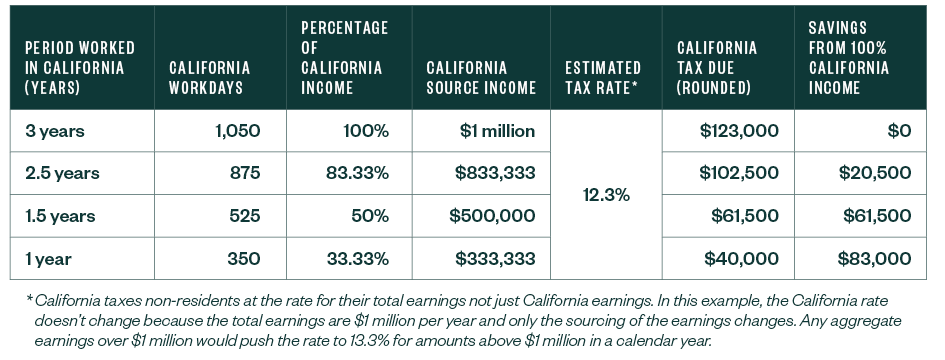

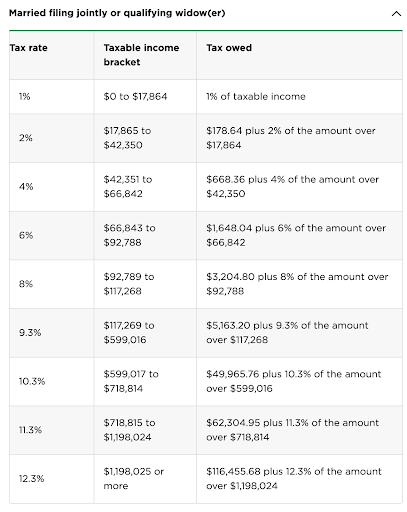

For very high earners 360K for single filers and 720K if married filing jointly you may need to pay California estimated taxes. Contrast that with a 45 all-in tax rate which requires 450 to vest into 10 of RSUs. Allocation Ratio 180 days 365 which is 49.

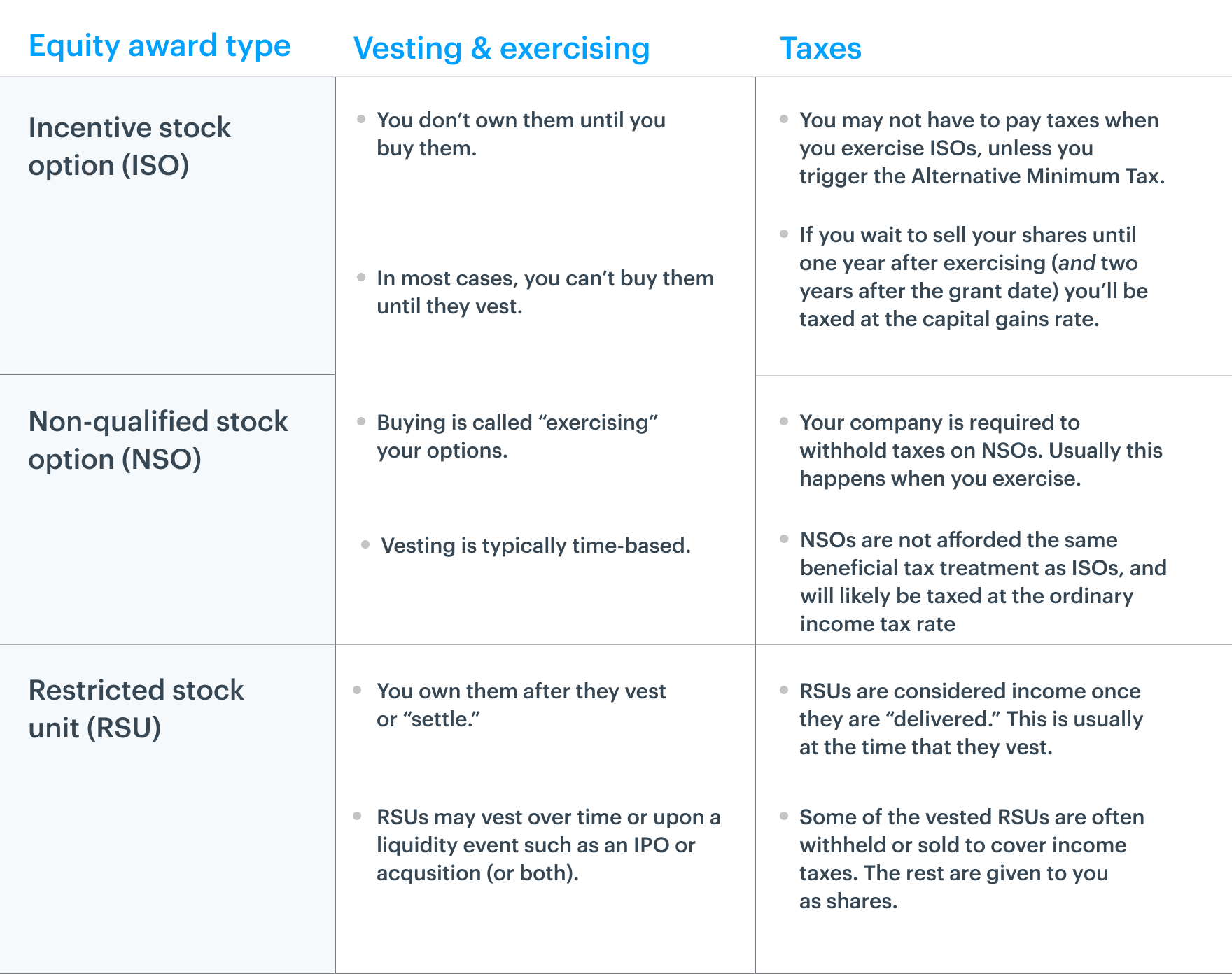

On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. RSUs including so-called double-trigger RSUs are taxed. RSUs are taxed as income to you.

With an all-in tax rate of 15 you only need to pay 150 for every 10 of RSUs that you vest into. For California income tax the mandatory withholding rate is 1023. On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers.

What it means is that your stock broker will automatically calculate how much tax you should owe on your vested RSUs and will sell a portion of them right away and give it to the IRS as tax withholdings. On January 1st 2022 250 shares 14 of your RSUs will vest at a stock price of 10. This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised.

You will owe income tax both federal and state if. The taxation of RSUs is a bit simpler than for standard restricted stock plans. With RSUs if 300 shares vest at 10 a share selling yields 3000.

Its important to understand the amount withheld on future rsus to avoid hefty tax charges afterward or even penalties. Here is an article on employee stock options. Value of the unvested RSUs before taxes.

The short answer to your question is that the RSUs are taxed at vest and upon sale of the resulting shares. There are two main formulas that the courts in California developed to determine how RSUs are divided in divorce the Hug formula and the Nelson formula. With RSUs youre subject to California income tax when the shares are delivered to you.

Theyre taxed as ordinary income - so its based on your marginal tax bracket. How Are Restricted Stock Units RSUs Taxed. The allocation ratio is.

How are RSUs taxed in the state of California. Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million. And keep in mind that when your shares vest in 2021 and 2022 a portion will still be taxable in California.

Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. Again consult with a financial planner or tax professional. RSUs including so-called double-trigger RSUs are taxed as ordinary income from compensation when they vest.

When your restricted stock units vest and you actually take ownership of the shares two dates that almost always coincide the value of the stock at that vesting date gets included in your income for the year as compensation. This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers. Upon sale of the resulting shares.

The RSUs all vested in 2012 two years after the taxpayer became a California nonresident after moving abroad. For restricted stock units RSUs California has a formula for determining how much of the income from your RSUs is California income. I have a question on how RSUs vest for non-residents who become temporary residents of California.

Even if the share price drops to 5 a share you could still make. A third option is to use one of the formulas for dividing stock options and RSUs in California which are described in more detail below. Here is how RSUs are taxed.

If you have RSUs at a private company the logic is the same as explained above but the allocation ratio is determined by grant date and liquidity date your. The Hug Formula and the Nelson Formula. Income taxable in CA.

As your actual tax rate increases including FICA state taxes etc it becomes more expensive to vest into RSUs. Compared to these other forms of equity compensation the tax treatment of RSUs is pretty straightforward but still important to understand. Taxation of RSUs.

The IRS and California FTB measures your RSU income as each tranche vests. If youre in the 25 bracket and get 10k of RSUs youd pay about 25 federal tax and 9 state tax 35k. RSUs can also be subject to capital.

Because there is no actual stock issued at grant no Section 83 b election is permitted. You have to pay taxes as soon as the RSUs vest and the IRS and FTB withholds sever. This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers.

In some cases you might pay taxes in California for years after leaving. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest.

I want to hear your stories. Lets consider this example. The total amount of rsus will show up.

Say 10 rsus vest on one day and the stock price on that day is 5 per share. You will owe income taxes on it when you file your 2016 taxes next year. Restricted Stock Units RSUs are taxed differently than other forms of equity comp such as Options and Employer Stock Purchase Plans ESPP.

Originally reporting the full value of the RSUs on his California nonresident return the taxpayer subsequently filed an amended return and claimed a refund based on the stock price when he left California.

Restricted Stock Units Jane Financial

How State Residency Affects Deferred Compensation

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units Jane Financial

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

How Equity Holding Employees Can Prepare For An Ipo Carta

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Rsu Vs Rsa What S The Difference District Capital Management

Restricted Stock Units Rsus Explained 4 Tax Strategies For 2022

California Income Tax And Residency Part 2 Equity Compensation And Remote Work Parkworth Wealth Management

Restricted Stock Units Jane Financial

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units Jane Financial