maryland student loan tax credit application 2021

There were 9155 Maryland residents who were awarded the 2021 Student Loan Debt Relief Tax Credit. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission.

6 Best Student Loans Of 2022 Money

It was established in 2000 and has been an active part of the American Fair Credit Council the US Chamber of Commerce and is accredited with the International Association of Professional Debt Arbitrators.

. Student Loan Debt Relief Tax Credit Application. Ad Use Our Comparison Chart Pick Between The Best Student Loan Rates Available. This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit. The Student Loan Debt Reli ef Tax Credit provides Maryland income tax credits to eligible recipients to apply against student loan balances that were used to pay for undergraduate and graduate postsecondary education. Ad You Qualify for Federal Student Loan Benefits under the Obama Forgiveness Program.

Comptroller Peter Franchot urges eligible Marylanders to act fast and apply for the Student Loan Debt Relief Tax Credit Program for Tax Year 2021. Its regrettable that the cost of higher education is preventing many people. Currently owe at least a 5000 outstanding student loan debt balance.

The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe. Click Now Choose the Best Personal Student Loans with the Lowest Rates. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

September 2 2021 Comptroller Peter Franchot urges eligible Marylanders to act fast and apply for the Student Loan Debt Relief Tax Credit Program for Tax Year 2021Applications must be submitted by September 15. The Student Loan Debt Relief Tax Credit is a program. Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I.

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. Student Loan Assistance Programs are for those who make between 30k - 200k Per Year. September 2 2021 - Comptroller Peter Franchot urges eligible Marylanders to act fast and apply for the Student Loan Debt Relief Tax Credit Program for Tax Year 2021.

About the Company Maryland Student Loan Debt Relief Tax Credit Reddit. If the credit is more than the taxes you would otherwise owe you will receive a tax refund for the difference. The tax credits were divided into.

When setting up your online account do not enter a temporary email address such as a workplace or college email. About the Company Student Loan Debt Relief Tax Credit Maryland 2021. Applications must be submitted by September 15.

For example if you owe 800 in taxes without the credit and then claim a 1000 Student Loan Debt Relief Tax Credit you will. For Maryland Resident Part-year Resident Individuals Tax Year. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by providing a tax credit on their Maryland State income tax return. From July 1 2022 through September 15 2022. The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who.

CuraDebt is a debt relief company from Hollywood Florida. Complete the Student Loan Debt Relief Tax Credit application. MHEC Student Loan Debt Relief Tax Credit Program 2019.

Its regrettable that the cost of higher education is preventing many people from pursuing their college dreams Comptroller. Ad Download Or Email App HTCE More Fillable Forms Register and Subscribe Now. Student Loan Debt Relief Tax Credit for Tax Year 2021.

If you already have. The Student Loan Debt Relief Tax Credit is a program created under 10. The Maryland Higher Education Commission MHEC is continuing their Student.

We are aware that student loan debt has become a growing concern among college graduates and wanted to remind you of a tax credit that you may be able to take advantage of. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents Tax Year 2021 Only Instructions. The Loan Assistance Repayment Programs LARP can assist Maryland residents in certain careers with student loan debt repayment.

It was established in 2000 and is an active member of the American Fair Credit Council the US Chamber of Commerce and is accredited by the International Association of Professional Debt Arbitrators. Its regrettable that the cost of higher education is preventing many people from pursuing their college dreams Comptroller. To be considered for the tax credit applicants must.

Include the Supporting Documentation listed below including proof of the educational undergraduate loans that qualify for the credit and a complete official copy of your college transcripts. Applications must be submitted by September 15. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are eligible to apply for the Student Loan Debt Relief Tax Credit.

Permanent email addresses are required for issuing tax credit awards and for all future correspondence from us. CuraDebt is a debt relief company from Hollywood Florida. A copy of the required certification from the Maryland Higher Education Commission must.

This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. Effective January 3 2008 the Maryland sales and use tax rate is 6 percent as follows. MHEC Student Loan Debt Relief Tax Credit Program for 2021 Apply by September 15th.

Detailed EITC guidance for Tax Year. 1 cent on each sale where the taxable price is 20 cents. Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan debt undergraduate or graduate and.

How The Tcja Tax Law Affects Your Personal Finances

Stimulus Payments May Be Offset By Tax Debt The Washington Post

Can I Claim A College Student As A Tax Dependent H R Block

Maryland Stimulus Check Relief Act 2021 Details As Com

More Than 9k Marylanders Will Receive Student Loan Tax Credit Hogan Says Cbs Baltimore

Child And Dependent Care Credit H R Block

6 Best Student Loans Of 2022 Money

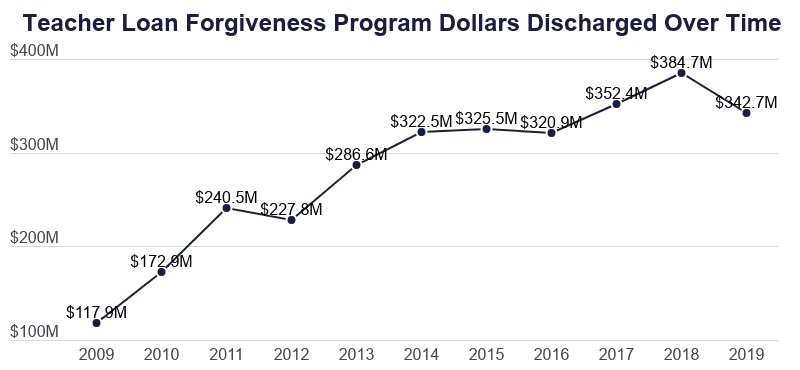

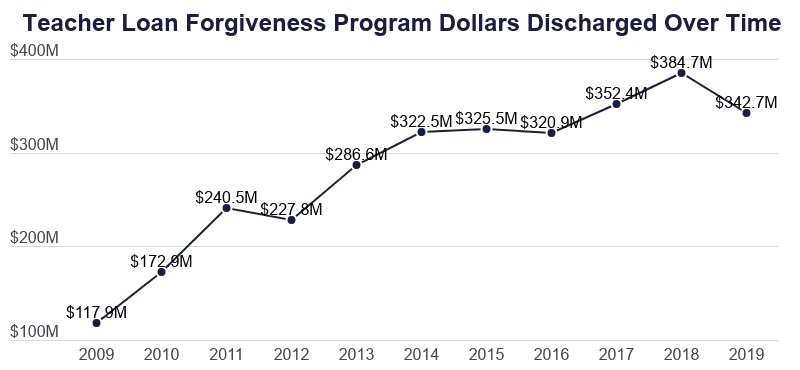

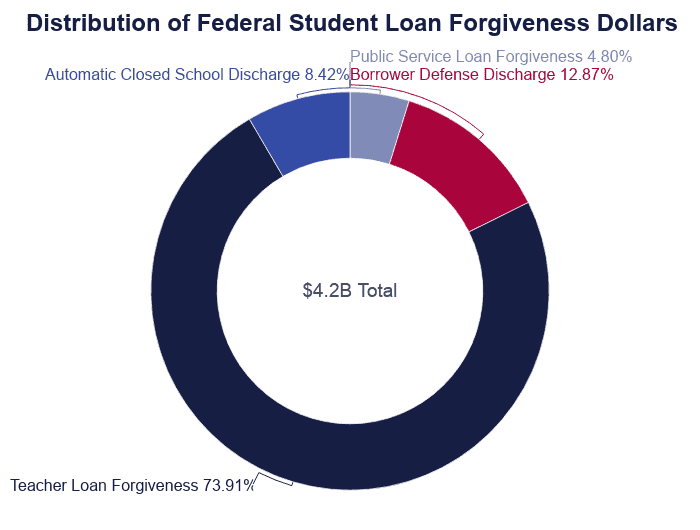

Student Loan Forgiveness Statistics 2022 Pslf Data

Irs Child Tax Credit Payments Start July 15

Chill S Corner Llc D B A Security Income Tax Service Home Facebook

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College Bond Funds

Maryland Student Loan Forgiveness Programs

Child Tax Credit November Payments Arriving In Parents Bank Accounts Cbs Baltimore

Navient Student Loan Settlement Who Qualifies For Relief And What To Do

Student Loan Forgiveness Statistics 2022 Pslf Data

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Student Loan Mess Looms Borrowers Do These 6 Things By September